Welcome to the National Maritime centers instructional video on completing the US Coast Guard seven one nine series of applications form CG seven one nine B. This form is for license as an officer staff officer or operator and four merchant mariners. Each section listed in the instruction corresponds with a specific section of the application form. Figure one on page three provides a table detailing the different endorsement categories and transaction types to assist you in making the appropriate selection during the application process. Please read these instructions carefully prior to filling out the application section one of this form consists of personal data. FILL OUT EACH BLOCK IN THIS SECTION OR WRITE N/AN IF NOT APPLICABLE WHEN YOUR CREDENTIAL IS ISSUED BY MAIL. THE ADDRESS IN THIS SECTION IS USED WHEN YOUR PERSONAL INFORMATION IS ACCURATE. MAKE SURE YOUR PERSONAL INFORMATION IS ACCURATE AND REPORT CHANGES IMMEDIATELY. SECTION TWO OF THIS FORM CONSISTS OF THE TYPE OF TRANSACTION YOU ARE REQUESTING. PLEASE CHECK CHECKS IN THE APPROPRIATE BOXES MULTIPLE SELECTIONS IN THIS SECTION ARE AVAILABLE IN THE DESCRIPTION OF ENDORSEMENT DESIRED BOX. BECOME SPECIFIC ABOUT THE CREDENTIAL YOU ARE REQUESTING. THIS BOX APPLIES TO RENEWAL TRANSACTIONS ONLY IF YOU WANT YOUR RENEWAL MMC ISSUED IMMEDIATELY INSTEAD OF HAVING ITS ISSUANCE COINCIDE WITH THE EXpiration OF YOUR PREVIOUS CREDENTIALS. CHECK THIS BOX. SECTION THREE OF THIS SECTION COVERS SAFETY AND SUITABILITY PART ONE SHOULD BE MARKED IF YOU ARE EXEMPT FROM HOLDING A VALID TWIC UNDER COAST GUARD POLICY LETTER 11-15 FOR MORE INFORMATION ON THIS EXEMPTION PLEASE REFER TO THE POLICY LETTER SECTION OF OUR WEBSITE FOR PART TWO CONVICTIONS AND DRUG USE MARK THE APPROPRIATE RESPONSE AND COMPLETE THE CG 7 1 9 C FORM FOR ALL AREAS MARKED YES REMEMBER TO COMPLETE ALL BLOCKS IN THIS SECTION...

PDF editing your way

Complete or edit your travel order military anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export standard order military pdf directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your cg5131 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your travel order military pdf by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Price Items

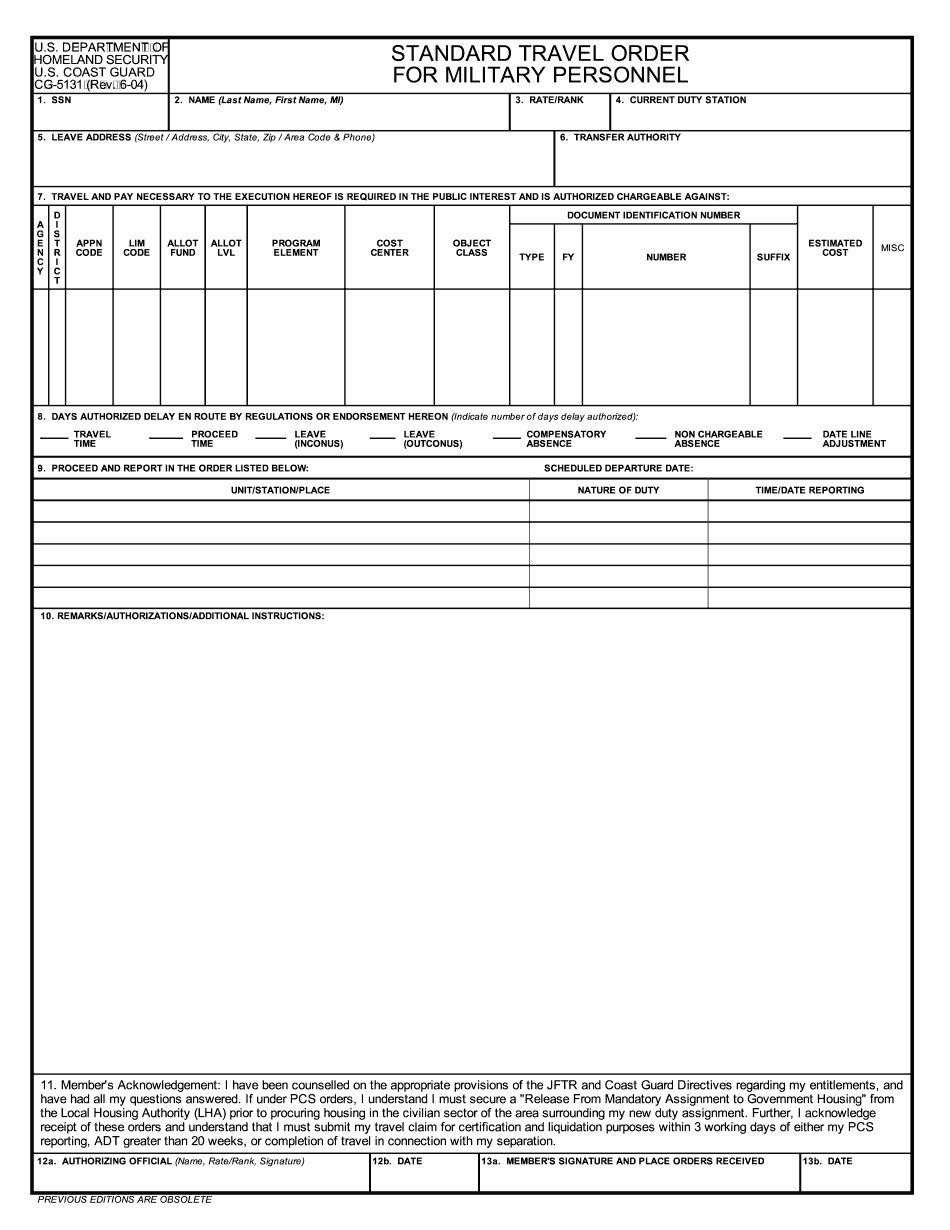

- The form CG-5131 is also known as a standard travel order.

- The form includes fields for member's acknowledgement and authorizing official.

- It is mandatory to report travel claim for certification within 3 working days.

Award-winning PDF software

How to prepare Price Items

About Form CG-5131

Form CG-5131 is an official document used by the United States Coast Guard (USCG). It is known as the "Dangerous Drug and Alcohol Testing Reporting Form." This form is to be completed by maritime employers subject to drug and alcohol testing regulations, as outlined in Title 46 Code of Federal Regulations (CFR) Part 16. The CG-5131 form is designed to report any suspected drug or alcohol-related incidents involving employees in safety-sensitive positions in the maritime industry. These incidents typically involve activities such as operating vessels, maintaining navigational equipment, or handling hazardous materials. The form requires employers to detail the specific circumstances of the incident, including date, time, location, individuals involved, and a description of the alleged drug or alcohol-related behavior. It also requires employers to provide information on any testing conducted in response to the incident, such as drug tests, breathalyzer tests, or other forms of screening. By submitting the CG-5131 form, employers help the USCG monitor and enforce drug and alcohol regulations to ensure the safety and security of maritime operations. The form assists in identifying potential risks and taking necessary actions to prevent accidents and maintain the integrity of the maritime industry. In summary, the CG-5131 form is an important tool for maritime employers subject to drug and alcohol testing regulations, helping them report and document incidents related to drug and alcohol abuse.

How to complete a Price Items

- Make sure to complete all fields accurately and follow any specific instructions provided on the form

People also ask about Price Items

What people say about us

Complicated document management, simplified

Video instructions and help with filling out and completing Price Items